Hatching Growth #9: Acquisition-First, the AARRR Ladder, and Turning Core Actions into a Growth Engine

Glasp’s note: This is Hatching Growth, a series of articles about how Glasp organically reached millions of users. In this series, we’ll highlight some that worked and some that didn’t, and the lessons we learned along the way. While we prefer not to use the term “user,” please note that we’ll use it here for convenience 🙇♂️

If you want to reread or highlight this newsletter, save it to Glasp.

Recap: #1–#8 in one glance

#3: How We Rode the AI Wave with Side Projects Before It Exploded

#8: How We Doubled Down on YouTube Summary with Programmatic SEO

Introduction

In previous Hatching Growth posts, we’ve shared the trajectory of our growth journey: the breakout success of YouTube Summary, the Next One Million Project, and, in the last post, how we doubled down on YouTube Summary through programmatic SEO.

In this installment, we step back to examine the big-picture concepts that guide our thinking about growth. These approaches weren’t clear to us at the outset—they are the result of continuous learning. What we outline here represents what has worked for us in B2C, but the right playbook will differ across B2B, B2C, and other industries. Please take this as a reference practice, not a universal formula.

In early-stage consumer products, the fastest path to compounding growth is to (1) earn awareness, (2) acquire and activate users on a single core action, and (3) make that action produce assets that attract the next wave of users. This post lays out how we do that, using the AARRR framework as a practical sequence—not a checklist.

TL;DR

Work the funnel in order: Awareness → Acquisition → Activation → Retention → Referral → Revenue. Don’t jump ahead.

Awareness before Acquisition, because nobody knows you yet. Founders should sell, not just “market,” until the motion is repeatable.

Define one core action and optimize everything to make more new users perform it once (for us: make a highlight).

Heuristic math: ~1% of impressions → sign‑ups; ~1% of sign‑ups → long‑term “loyal” users (varies by product). That implies you need a lot of qualified awareness.

Choose channels from LTV/CAC reality: if LTV/user is low, default to zero‑paid channels (SEO, product‑led virality, social, UGC) and tighten activation.

Turn core actions into growth assets: make user actions generate public, indexable, recommendable content that powers SEO/AEO and in‑product recs.

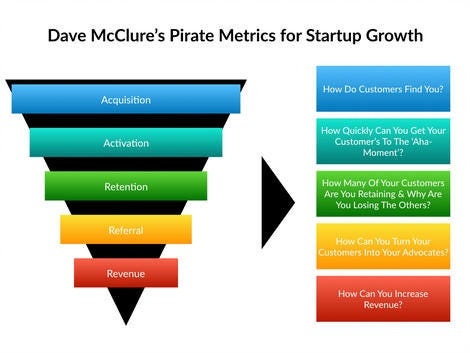

The AARRR ladder (applied, not academic)

Awareness → People notice you exist.

Acquisition → They land and sign up.

Activation → They do the core action that lets them feel value.

Retention → They come back because they felt value.

Referral → They bring others (explicitly or implicitly).

Revenue → You monetize without breaking the motions above.

We climb in this order. Optimizing revenue before activation reduces the surface area for learning and throttles compounding effects.

Why awareness and acquisition must lead

When you’re unknown, no one shows up to your launch. Without awareness, there is no acquisition; without acquisition, there is no activation, no retention, no revenue. Early on, the most efficient path is for founders to do sales-like work:

DM friends and early adopters, run 1:1 onboarding calls, show the product live.

Treat every conversation as discovery for positioning, core action clarity, and channel-market fit.

Once you have a trickle, you can systematize and scale.

For more on this idea, see Jessica Livingston’s classic essay: Why Startups Need to Focus on Sales, Not Marketing, and also our own story in Hatching Growth #1: How We Found and Acquired Our First 1,000 Users.

Channel selection starts with LTV math

(See also Hatching Growth #2: How We Chose Our Growth and Acquisition Channels)

Your business model dictates your channel menu.

Low LTV (typical B2C utilities): You can’t afford paid CAC. Focus on SEO, UGC-driven virality, social reach, and product loops.

High LTV (typical B2B): You can (and should) validate with paid or sales-driven motions where revenue is the primary signal and you build for paying users first.

Our case: B2C with low per-user LTV ⇒ we avoid paid acquisition and focus on SEO + viral loops.

Practical heuristics for top-of-funnel math

Numbers differ by product, but as a planning heuristic we’ve observed:

~1% of awareness (impressions) → sign-ups.

~1% of sign-ups → loyal users (who keep doing the core action and often refer others).

That implies: to get 10 loyal users, you might need ~1,000 sign-ups, which may require ~100,000 impressions. This is why awareness scale and activation quality both matter. That said, these ratios vary depending on the nature of the product and the strength of the pain point it addresses. Even within Glasp, for example, conversion rates differ between YouTube Summary and the Web Highlighter. The stronger and more appealing the product, the higher the conversion at each stage.

Activation: define one core action and remove every barrier

Pick one action that correlates with long-term retention. For us, it’s creating a highlight (install extension → highlight once). Tactics that improved first-action rate:

Ruthless first-run simplification; hide everything non-essential.

Guided onboarding (we’ve done hundreds of 1:1 calls when needed, as we shared in Hatching Growth #1).

In-product prompts that lead directly to the core action.

Fast follow emails/messages that nudge users back to complete the action.

Why activation dominates: 100 sign-ups with 5% activation means 95% never experience value. Until activation is decent, everything else is noise. As Sean Ellis has emphasized (see his shorts on growth fundamentals), activation is the single most important step—without it, no one truly experiences the product’s value. By the way, we also interviewed Sean Ellis on Glasp Talk, where he shared deeper insights into why activation is critical for sustainable growth.

Retention: lightweight, scheduled touchpoints

Once users perform the core action, retention improves substantially. We reinforce value with a simple cadence (example):

+1 day, +3 days, +7 days, +14 days, +30 days, +90 days emails/messages.

“Review your highlights,” “Revisit your Kindle highlights,” etc.

Occasional feature nudges that deepen the core action (import, PDF, audio transcription, etc.).

From a Product Management perspective, retention is the most critical signal. Building a great product based on user insights is essential, and when new trends emerge, it’s wise to invest resources before they explode—because once they do, the game can change overnight.

If your weekly or monthly retention is weak, it may be better to pivot rather than keep shipping features. In our case, we’ve been fortunate not to need a major pivot, but we tested many side projects along the way. See also Hatching Growth #3: How We Rode the AI Wave with Side Projects Before It Exploded.

Referral: track it, don’t overengineer it (early)

We track referrers but we don’t force financial incentives early. Organic word-of-mouth contributes a meaningful slice by default once activation/retention are healthy. Build explicit programs later.

For a practical example, see our help article: How to see the number of people you invited to Glasp?

Revenue: when and how to turn it on

We maintain a frictionless free entry to maximize activation and UGC creation, and monetize later where it doesn’t block the core loop. When you do turn it on:

Keep checkout low-latency; minimize churn sources (e.g., failed payments, disputes) with clear value and support flows.

Optimize pricing after you have usage segmentation data.

Timing matters:

In B2C, delay monetization until you have meaningful volume. Early focus should be on scale and activation. Our own case with YouTube Summary showed that testing monetization earlier and allocating some budget to low-cost TikTok promotion might have produced a different outcome—but the general principle still applies that scale comes first in B2C.

In B2B, it often makes sense to monetize sooner, since revenue validation from paying customers is the primary signal.

When to test:

Once you retain well, solve a clear pain point, and have a repeatable acquisition engine, you may be generating thousands of sign-ups per day. At that scale, it makes sense to run A/B tests on activation, retention, referrals, and eventually revenue—because you have enough volume to learn quickly.

By contrast, a B2C product with fewer than ~100 sign-ups per day should avoid premature revenue A/B tests. The sample size is too small, and energy is better spent on tightening activation and retention. Once those loops are solid, revenue optimization compounds more effectively.

B2C vs. B2B: different sequences of truth

B2B: Customer count is limited; CAC is high; revenue validation leads. Build for paying users; ignore non-paying signals.

B2C: Potential volume is high; CAC must be near-zero; awareness scale and activation lead. AB test with flow traffic; postpone monetization friction.

Big picture: why B2C must focus on user growth first

In B2C models, long-term monetization options are limited: subscriptions, advertising, and—if users consent—aggregated anonymized data sales. Because LTV per user tends to be low, the path to building a large business is through scale of users. The underlying concept is simple: once you have massive user numbers and engagement, you have flexibility to monetize later through multiple avenues. This is why early B2C products should obsess over growth and user actions rather than premature monetization.

That said, dynamics shift with new technologies (e.g. AI) and distribution channels. Since TikTok, we’ve seen fewer new mega-scale consumer products emerge, and it’s not guaranteed that the old playbook works unchanged. But the core principle remains: if your LTV is low, then focus on growth first—because with enough users, monetization opportunities open up.

Scaling what works: short-form reach now, SEO later

Short-form video & social (TikTok, Shorts, X/Twitter): Best for rapid spikes and learning; great if someone on the team is natively excellent at it. Can drive thousands of experiments and sign-ups cheaply.

In Glasp’s early days, we experimented with quote-style TikTok content, but quickly pulled back. The user base wasn’t a natural fit, and the product itself is text-focused rather than video-native, so the channel felt mismatched. Looking back, however, we see opportunities we missed—such as partnering with low-cost creators in English-speaking markets. In particular, not reinvesting into TikTok after YouTube Summary broke out was a strategic mistake. We also briefly automated the creation of YouTube Shorts from collected quotes. Once the quotes were gathered, the system could keep publishing Shorts automatically—a structure we built and tested once, though we didn’t scale it further.

For B2C especially, it’s critical to test early on TikTok, X, or whichever channels your target users already inhabit. Even if product–channel fit isn’t obvious, experimenting there early can reveal disproportionate growth opportunities.

SEO/AEO & content: Slow to compound, but once moated, it delivers durable, low-CAC acquisition. Pursue in parallel only if you can commit long enough to see the curve bend.

The flywheel: make core actions produce growth assets

The biggest unlock is designing your product so that user actions generate assets that:

Improve acquisition (public, indexable UGC that fuels SEO/AEO and social discovery), and

Improve product value (better recommendations, follow graphs, and learning systems).

In our case, highlights are UGC:

More highlights ⇒ more public content ⇒ better SEO/AEO surface ⇒ more new users.

More highlights ⇒ better in-product recommendations and follow suggestions ⇒ higher retention and activation for the next user.

This is the difference between linear growth (manual posting/ads) and compounding growth (assets that work while you sleep).

We’ll share more about how Glasp leverages UGC for growth in a later Hatching Growth series post.

Metrics that matter (by stage)

Awareness: Impressions, reach, qualified traffic sources. In practice, check Google Analytics daily: how many new user visits you had, how many reached the sign-up page, and from which channels they came. It also helps to note daily events that could have influenced traffic. For example, in our case: a viral post on X, being featured in media, or a YouTube placement. Tracking these alongside the numbers makes it easier to attribute spikes and learn which triggers matter.

Acquisition: Visit→signup %, source quality.

Activation: % of new users completing the core action once.

Retention: D7/D30 retention of activated cohort. In practice, track how many of the users who performed the core action are still active after 7 and 30 days. Pair this with notes on interventions (emails, feature nudges, product updates) so you can connect retention changes with concrete experiments.

Referral: % of new users with a known referrer; K-factor if applicable.

Revenue: Paid conversion of retained users; net revenue retention; dispute/failed payment rate.

Closing

Growth isn’t a bag of hacks; it’s an ordered set of motions that reinforces itself when the core action produces assets. Start with awareness you can actually earn, make first success inevitable, and design the system so every action makes the next user more likely to succeed.

If you have questions or want a teardown of your core action and loop design, drop a comment—happy to help.

By the way, we also wrote a Product Growth Handbook at Glasp in the past—if you’re interested, you can check it out for more structured lessons.

Partner with Glasp

We currently offer newsletter sponsorships. If you have a product, event, or service you’d like to share with our community of learning enthusiasts, sponsor an edition of our newsletter to reach engaged readers.

We value your feedback

We’d love to hear your thoughts and invite you to our short survey.

Thank you for reading!

In this post, we showed a big picture of growth, how we used the AARRR framework, and what experiments we worked on in each stage.

As the Hatching Growth is a series for early-stage founders building a product globally, we hope it helps, and let us know if you have any questions or feedback!

Really appreciate how clearly this lays out the sequencing of growth. The reminder that awareness must come first, and that activation is the real bottleneck, feels especially relevant. I like the framing of the core action not just as value delivery but as an asset that compounds over time. This mindset makes the difference between linear growth and a true growth engine.